Enjoy superior conditions with ThinkMarkets

Tight spreads

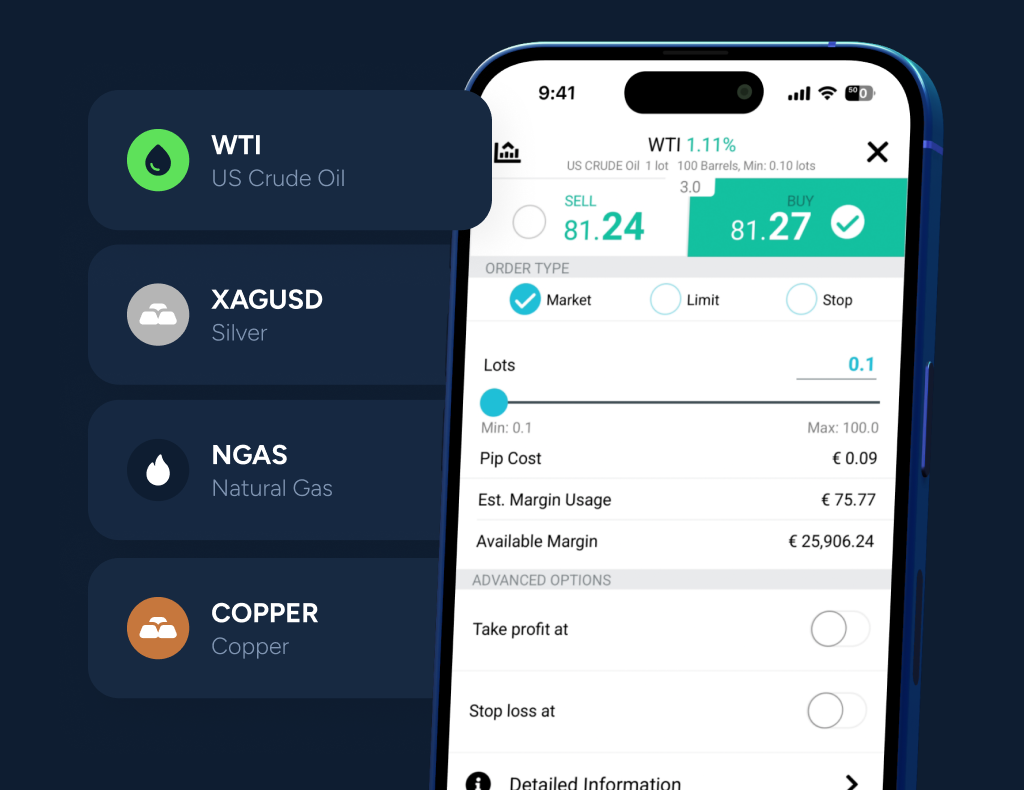

Benefit from tight spreads from as low as $0.02 on WTI and BRENT.

10:1 leverage

Control a position on WTI up to $10,000 in size with just a $1,000 deposit.

Flexible contract sizes

Choose a contract size that meets your trading needs, starting from just 0.1.

Why trade commodities?

Trade in both directions

Trade both the upward and downward price movements on all the commodities we offer.

23/5 market access

Explore opportunities with 23/5 market access to the world’s most popular commodities.

Gain broad exposure

Diversify your portfolio and gain exposure to a wide range of hard and soft commodities.

Commodities CFD trading scenarios

COMMODITY

WTI

ENTRY PRICE

$80

TRADE SIZE

100 contracts

TRADE VALUE

$80 x 100 = $8,000

REQUIRED MARGIN (10:1)

$8,000 / 10 = $800

Going long (buy)

Going short (sell)

Your research tells you that gold’s price is going to rise.

SCENARIO A

EXIT PRICE

$82

PROFIT/LOSS

=(Exit price - entry price) x Trade size

=(82 - 80) × 100

=2 x 100

=200

Profit $200

SCENARIO B

EXIT PRICE

$78

PROFIT/LOSS

=(Exit price - entry price) x Trade size

=(78 - 80) × 100

=-2 x 100

=-200

Loss $200