Infomedia (ASX: IFM)

Rating: ADD

Fair Value Target: $1.76 (+17%)

Dividend Yield: 3.6% fully franked

Highlights

- IFM company overview

- IFM financial performance

- IFM technical analysis

- Conclusion

Company Overview

IFM provides automotive industry software solutions to assist dealers and service providers to manage their automotive parts requirements, customer service, and overall productivity. IFM's products are cloud native and are sold under a software as service "SaaS" model.

IFM's revenues are roughly equally split (albeit modestly skewed towards the USA), between USA, EMEA, and Asia Pacific. Its products are sold in 186 countries and used by over a quarter of a million automotive industry professionals, thus making IFM a genuinely global company.

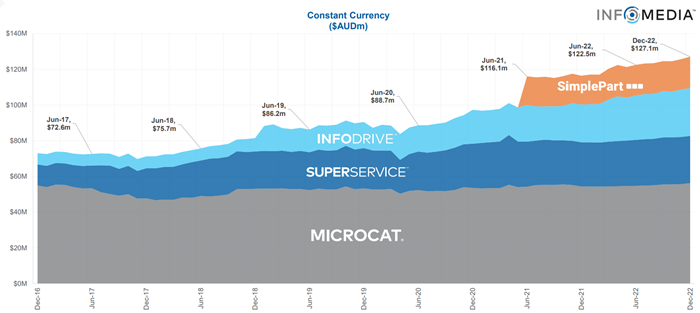

Click to enlarge: H1 FY23 annual recurring revenue (ARR) breakdown IFM business segments

Click to enlarge: H1 FY23 annual recurring revenue (ARR) breakdown IFM business segments

IFM operates within four main categories. The main contributor to earnings is its parts selling platform, which contains the brands Microcat EPC (electronic parts catalogue), Microcat Market, and Microcat Partsbridge. The Microcat suite allows automotive dealerships and service providers to manage their parts stocking and ordering seamlessly through the ordering to usage cycle.

The next most influential business unit on IFM's earnings is its service management platform, which contains software sold under the Superservice brand (i.e., Menus, Triage, Register, and Connect). This software enables dealerships to end-to-end management of customer bookings, quoting, servicing reporting, and customer experience.

Growing in importance to roughly match Superservice in terms of its earnings contribution is IFM's cloud-based digital insights platform, Infodrive. Infodrive allows dealerships to better understand the key data their business is generating, including productivity and performance, sales and marketing, and customer analytics.

Finally, the recently acquired SimplePart provides automotive dealerships with an e-commerce platform to manage B2B and B2C sales of parts, accessories, and services. Through the SimplePart platform, dealers and parts manufacturers and distributors can create and manage their own branded website and online store. The platform also includes access to digital marketing support.

Financial Performance

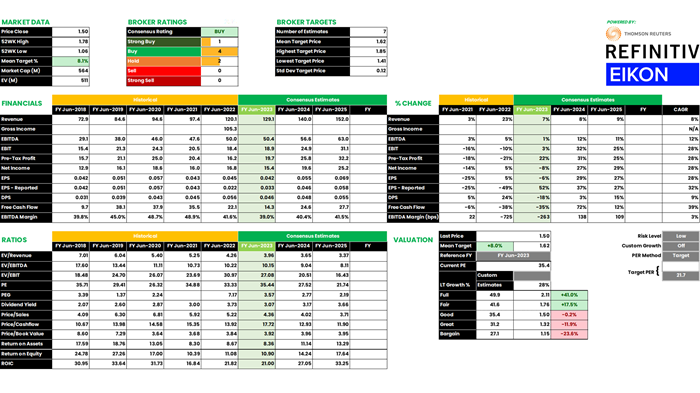

Click to enlarge: Infomedia Refinitiv Eikon Data

Click to enlarge: Infomedia Refinitiv Eikon Data

The Thomson Reuters Refinitiv Eikon spreadsheet shows all the relevant historical and consensus forecast financial data for IFM.

There are 7 brokers covering the stock, of which 1 rates IFM as a Strong Buy, 4 rate it as a Buy, and 2 rate it as a Hold. The brokers' average price target is $1.62, with a high target of $1.85, and a low target of $1.41. The average target allows 8% upside assuming a last price of $1.50.

The EPS line shows IFM's earnings grew strongly up until FY20, and then contracted in FY21 as the global COVID-19 pandemic wreaked havoc with automotive parts supply chains. FY22 and FY23 show a consolidation in earnings, and the company is forecast to rebound to solid earnings growth from FY24.

The compound annual growth rate (CAGR) in IFM's earnings to FY25 is an attractive 28% p.a., which compares very favourably with the overall market's average return of approximately 8%. You are paying a premium for that growth however, given the FY23 PE ratio is a substantive 35 times earnings (versus the average long-term market PE ratio of 15).

The target PE ratio of 21.7 was chosen as a more appropriate hurdle rate than the median forward PE of 27.5. It appears a more appropriate hurdle given the low of the 5-year historical PE range is 26.3.

Using the above target PE, and assuming a Low Risk level (reasons explained in Conclusion below), my fair value target for IFM is $1.76 which allows for approximately 17% upside from the recent close of $1.50. The valuation matrix views the current price of IFM as "Good" value.

Technical Analysis

Click to enlarge: Infomedia chart & technical analysis

Click to enlarge: Infomedia chart & technical analysis

The IFM charts shows its price is in a short-term uptrend (light green ribbon) and the long-term trend is neutral (orange ribbon). My trend ribbons tend to offer dynamic support when the price is above them and rising, and dynamic resistance when the price is below them and falling.

The transition from downtrend to uptrend is delineated by the transition of the respective ribbon from dynamic resistance to support. In this regard, the long-term trend has for me therefore returned to up, allowing me to consider adding risk to IFM assuming the parameters of short-term trend, price action, and candles also check out.

As suggested above, the short-term trend is a tick. The price action shows rising major points of demand in $1.165 (8 Feb) vs $1.105 (Jan 31) vs $1.06 (8 Dec 2022). The massive demand-side pulse on 24 Feb solidified the price action as higher peaks and higher troughs – a reliable indicator of increasing demand and decreasing supply.

Importantly, we have observed very little in terms of a supply side response to the 24 Feb demand-side pulse. This indicates supply is not overly motivated by the sudden increase in price, another strong bullish sign. Equally, even at higher prices, demand has remained resilient, dutifully working through the elevated supply triggered by the sudden price increase.

Candles are predominantly demand-side (i.e., white bodied and or lower shadows), and have occurred regularly through the recent consolidation below the $1.50 round number. These candles indicate to me a calm and measured intent by the demand-side to accumulate stock.

As supply dissipates, the price action is converging towards a breakout of the $1.50 level. I expect there will be little excess supply in the system until the major point of supply of $1.775 (2 Jun 2022) is reached.

With stops set at least below the $1.395 (6 Mar) demand point, there should be at least 1:1 reward to risk on a potential trade which commences by adding risk at current prices.

Conclusion

IFM operates a global SaaS business which is ubiquitous to the automotive dealership and service industry. Its earnings are geographically diverse, and it operates in a global automotive software market which is, and is expected to experience solid, double-digit growth.

Earnings should be resilient despite the current economic uncertainty as automotive sales, versus parts sales and servicing, tend to outperform at different stages of the economic cycle.

Based upon the broker consensus forecasts, my fair value target for IFM is $1.76. Add in an attractive fully franked dividend yield of 3.6%, and this suggests an attractive next twelve months potential return.

The chart demonstrates excess demand for IFM shares in the short-to-medium-term, with particularly strong demand evidenced in the recent price action and candlesticks. There appears to be attractive reward to risk fundamentals for a potential trade.

Given the above, I feel comfortable adding risk to IFM around current prices and continuing to add risk upon the observance of subsequent demand-side price action and candlesticks.

Download My Bear Market Survival Guide e-Book:

https://www.thinkmarkets.com/au/lp/2023-bear-market-survival-guide-ebook/

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre