*AUD holds with RBA still some distance from using QE

*Aussie Construction Work Data worth a look

*US consumer narrative slows on Nov. confidence drop

Thresholds not as Lowe as some thought

The

highly anticipated speech by Governor Lowe on unconventional policies offered plenty of key insights and takeaways for RBA policy moving forward, especially on the direction of when and what unconventional policies might be appropriate. One of his most important moments came when he said "quantitative easing (QE) becomes an option to be considered at a cash rate of 0.25 per cent, but not before that". This tells us that the

RBA only realistically have 50bps of cuts left before monetary policy reaches its effective lower bound (ELB) and QE enters the policy frame.

He also stressed that "if the RBA were to undertake a program of QE,

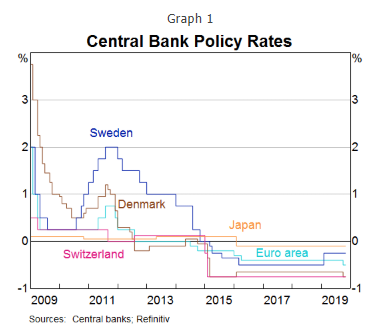

[they] would purchase government bonds", ruling out any appetite to undertake outright purchases of private sector assets. In his observations of other tools, Lowe questioned the efficacy of negative rates remaining steadfast that they are "extraordinarily unlikely" in Aus. Changes to extended liquidity operations were deemed unnecessary as things are operating normally. Examples of forward guidance had been mainly been positive.

Overall, while "QE is not on the [RBA's] agenda at this point in time", there appears scope for that to change should there be "an accumulation of evidence, that over the medium term, [the RBA] are unlikely to achieve [their] objectives". In other words, if the RBA fall short of 3% growth in 2021 (their central scenario), and lower unemployment and higher inflation fail to materialise - we could see unconventional policies come to the fore sooner rather than later. But as it stands, taking stock of Lowe's entire speech, we think

QE risks are largely removed in the near-term with thresholds yet to be reached.

AUDUSD realised vol jumped as price action whipped 30pips putting the pair trading only marginally higher from before the speech.

Aussie construction a window into housing supply

Aussie Q3 construction work done figures hit the wires at 11.30am AEDT, forecast to print -1.0%, an improvement on the prior quarter's -3.8%. The prior four quarters have registered negative prints in line with the weak supply story for Aussie housing. With Aussie housing prices in recent RBA speak looking better, there could be some upside to this number but that's more likely to be seen in Q4 we think. AUDUSD support near Nov. lows 0.6765 should be watched.

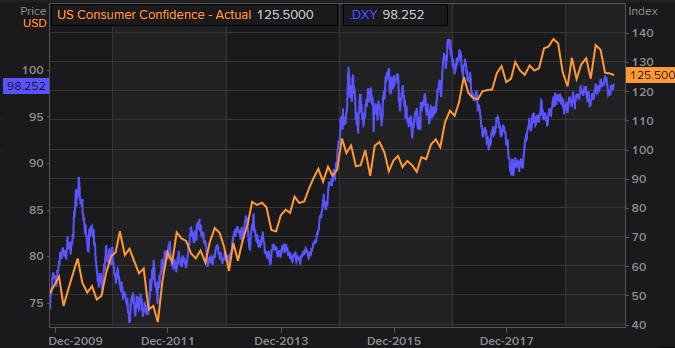

US Consumer Confidence index drops in Nov

Nov. US Consumer Confidence printed 125.5 below expectations of 127 making it the third month in a row where consensus has been missed. It brings into question the state of the US consumer and whether a slowing US consumer narrative is building. The Richmond Fed Index missed also seeing -1 against +5 expected. We look ahead to important US prints later tonight at

12.30am AEDT in durable goods and preliminary GDP, but also note that month-end rebalancing should see some

USD selling bias against G10 currencies.

US Consumer Confidence (RHS, orange). US Dollar Index (LHS, purple). Source: Eikon.