*Total income soared 17 percent

*Compensations reduced by over 20 percent

*Return on tangible assets to improve to 9%

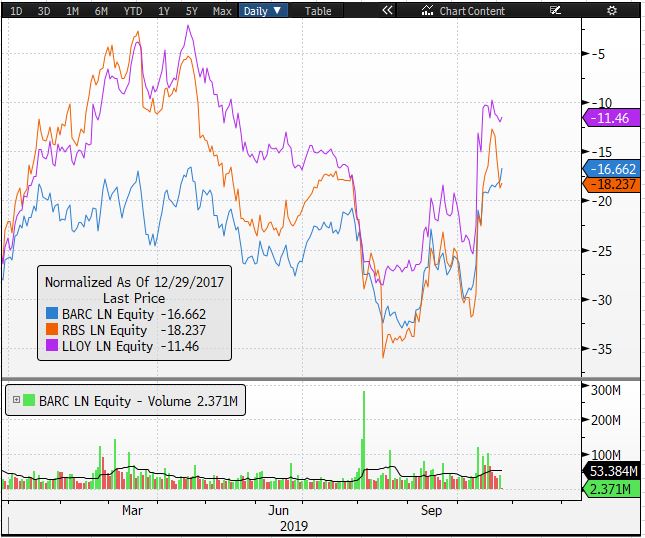

Barclays stock has lost more than 25% of its value since the new CEO has taken control of the area. From the earnings report, it is clear that the lending side of the business is suffering but the trading business has performed well. The completion on the high street can only be won by investing in technology because companies like Monzo, Revolout and several others have changed the game substantially. You cannot earn the same amount of profit in credit card business which you once had—clearly consumers are benefitting more, the way it should be.

In its earnings report, Barclays blamed the low-interest environment for its performance and on top of that, the bank also used the Brexit uncertainty as an excuse for its lackluster results. The earnings result announced by the bank were dismal. In fact, in so many ways, the theme was very similar to RBS. For instance, the weakness in the domestic economy is something both banks can’t get their heads around.

But there are some shinning spots in its earning reports. An area where the bank has performed well is the trading and corporate banking side, the total income soared 17 percent and this is mainly due to the improvement in equity and fixed income trading. In fact this area of the business really questioned the performance of the US banks because the trading income was nearly 6% higher.

Reducing expenses and improving the return on tangible assets is the key for the banks to perform well. It is pleasing to see that the company is committed to improve this by 9% during 2019 and increase it to 10% next year.

Barclays’ management team has been busy cutting jobs, it reduced its labour force by 3000 heads during this year and also it reduced different compensations by over 20 percent. But an aggressive measure in this area also means losing key talent, and Barclays has suffered from it. Some of the handpicked investment bankers by the CEO have walked out due to the bonus disagreements.

Overall, the bank's numbers were a lot better than other UK banks--apart from Lloyds--and this keeps Barclays on top of our favourite UK bank stock.

To conclude, the bottom line is that the bank needs to be active in making investments in the fintech area. It should Invest from it’s saving not only in the areas which have become challenging such as high street bank models but also in others as well.

Back