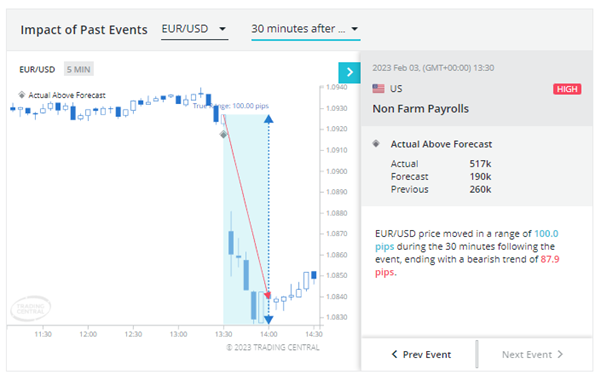

Last month, the release of the US Non-Farm Payrolls report (NFP) caused a 100-pip drop in EUR/USD, resulting in a boon for traders. The US Bureau of Labor Statistics reported that the US economy created 517,000 new jobs, which was 2.72 times more than projected by economists. However, some economists blamed the better-than-expected NFP outcome on seasonal and statistical factors, which could drop off in the February figure. This makes this week’s NFP report more interesting than usual. Additionally, the high probability that the EURUSD bull trend from late last year could come to an end with Friday’s NFP report is adding to the excitement.

How did last month’s NFP report impact the EUR/USD?

Data from

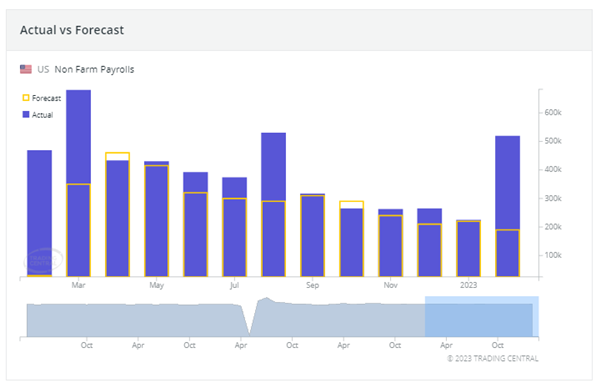

ThinkPortal chart shows that the NFP beat forecast by a wide margin, and the US labor market has, on average, beat expectations since February 2022. While growth in job creation has tapered off, it has not dropped as much as the markets and Federal reserve expected. This prompted Fed Chair Jerome Powell to warn in his annual Capitol Hill testimony that US interest rates could reach higher levels than the markets anticipate.

After last month’s NFP report, the EUR/USD dropped by 100 pips within the first 30 minutes following the release, as seen on the

ThinkTrader platform chart.

Non-farm payrolls growth anticipated to slow

Economists anticipate job creation to have dropped to 210,000 from 517,000 in January, and the unemployment rate should remain unchanged at 3.4% in the February job creation figures, which will be published on March 10, 2023, at 13:30 GMT.

How can we trade the EURUSD?

As of Thursday, March 9, at 10:44 GMT, the EURUSD was trading at 1.0560. The EUR/USD was down on the week following hawkish comments by Fed Chair Jerome Powell, and the price was resting above the 2023 low of 1.0474.

A break to the 2023 low would clearly mark the end of an uptrend that started in September 2022, and the price could drop to the next support level, the 1.0250 low. However, as the EUR/USD was already down on the week and resting above important support, the risk-reward ratio for a bearish position at current levels was poor. The price could gain but be capped by this week’s high of 1.0697.

Complicating matters for EUR/USD bears,

ThinkTrader's economic calendar statistics reveal that in the last 11 NFP reports, the EUR/USD has fallen within four hours of the Non-Farm Payroll publication, regardless of whether the data was better or worse than expected.

Even when the NFP outcome was lower than expected, the EUR/USD dropped in four out of five occurrences. This increases the likelihood that the longer-term up trend in the EUR/USD could come to an end after the upcoming NFP report.

However, to improve the risk-reward ratio of short positions, I might wait until next week for a breakout from the narrow range of 1.0474 – 1.0697, as seen in the chart below. A better-than-expected NFP outcome, but a delay in a drop of the EUR/USD, will only strengthen my conviction that the trend is over when and if the bears take out the 2023 low.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Center