Download Carl's Bear Market Survival Guide e-Book:

https://www.thinkmarkets.com/au/lp/2023-bear-market-survival-guide-ebook/

Download Carl's Bear Market Survival Guide e-Book:

https://www.thinkmarkets.com/au/lp/2023-bear-market-survival-guide-ebook/

The Reserve Bank of Australia (RBA) meets next week, Tuesday 4 July, and is expected to keep interest rates on hold. If it does, it would be the RBA's second pause in the current interest rate hiking cycle which has seen the bank increase its official cash rate from 0.10% in March 2022 to the current 4.10%.

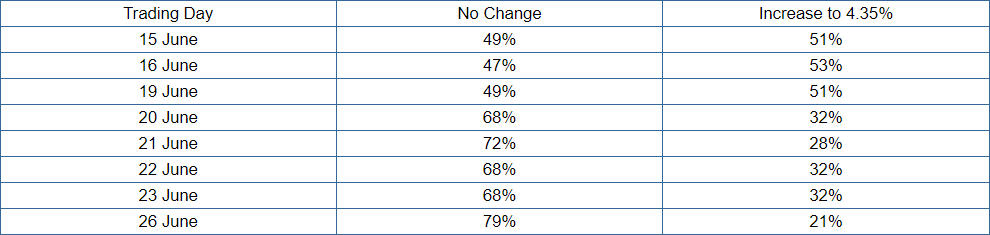

The meeting minutes from the RBA's June meeting showed its 0.25% increase from 3.85% was 'finely balanced', with a few RBA Board members considering a pause. This was a surprise for markets which had all but factored in another two more 0.25% rate increases in July and August. The table below shows just how sharply market pricing for Tuesday's meeting has changed. The June meeting notes were released on 20 June.

click to enlarge image

click to enlarge image

The table illustrates just how poorly the RBA has managed its messaging to markets. We went from a 50-50 chance of a 0.25% increase in July to 68-32 against. Ideally, we don't see such huge swings in market expectations from a central bank as it causes inefficiencies in the allocation of capital.

Watch the apple cart!

One thing which could upset the proverbial apple cart is the monthly Australian Consumer Price Index (CPI) which is scheduled to be released at 01:30 UTC Wednesday 28 June.

Market consensus suggests the AU CPI will show a local inflation rate of 6.1% p.a. after a modest monthly increase of just 0.1% in May. Whilst the monthly increase implies a 12-month annualised rate of just 1.2% p.a. if it can be maintained, the headline 6.1% p.a. rate remains well above the RBA's target of 2-3%, on average, over time.

We have seen some moderation in transport and holiday travel prices over the last few months, but the major concern for the RBA continues to be stubbornly high food and housing price growth. Also bullish for the Australian economy, and therefore facilitating higher interest rates, is the consistently resilient local labour market. May's increase of 76,000 jobs created streaked past economist's expectations for an increase of just 18,600 jobs.

Contrasting this, Australian retail sales have been flat at zero-growth for two months, and judging by 2023's readings, are growing at well-below long-term trend rates. Additionally, data last week showed the Australian manufacturing sector has been in contraction for four straight months, and the services sector is trending towards contraction as soon by as July if the last two-month's trends are repeated.

Recession risks grow, watch for AUD weakness

Australian stocks slumped last week and early this week as fears the RBA will tip the local economy into recession grew. Certainly, the bond market has voted, as it moved long-term rates below short-term rates. The Australian 10-year Government Bond yield is now yielding a few basis points below it's 3-year counterpart. Such an "inversion" in long-and-short-term yields is often viewed as a precursor to a recession.

This month's bond market gyrations haven't been seen since the global financial crisis, and as a result, investors continue to price in a more dovish RBA. This contrasts with investors' thinking about the US Federal Reserve, which maintains a hawkish tone – as just last week Chairman Jerome Powell reiterated that two more rate hikes may be necessary to control the US inflation problem. Such a combination of factors has caused significant pressure on the Australian dollar.

click to enlarge image

click to enlarge image

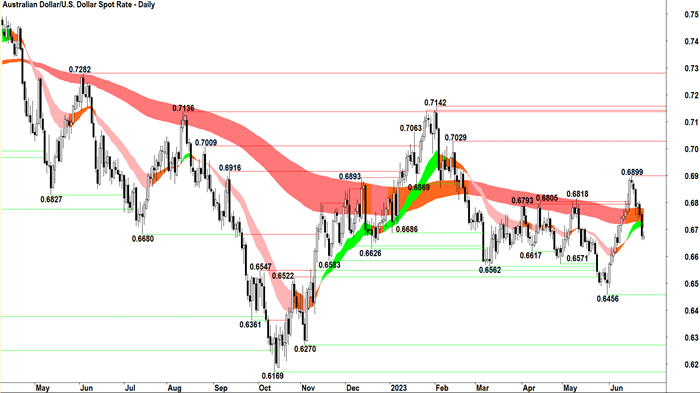

The AUDUSD has done an about-face since the release of the last RBA meeting minutes on June 20, plunging over 200 basis points. This, however, is less than half the increase it enjoyed since the May low as markets (it seems) incorrectly bet the RBA had at least two more 0.25% hikes left in it.

So, the AUDUSD is left in a state of flux. Not great for the trend traders, as the long-term trend ribbon (upper-most orange zone) is almost totally flat, and the short-term trend ribbon (lower orange zone) is also flattening out. Looking more broadly, the range between the May low of 0.6456 and the February high of 0.7157 are likely to hold in the medium-term.

Traders should watch the price action with interest here. If we see another peak formed below the 16 June swing high of 0.6899, it will likely signal a reinforcement of the long-term downtrend and precipitate a short-term downtrend. This would give traders a clearer run at shorts which could target 0.6456.

What to watch for in Wednesday's AU CPI

An-inline CPI reading on Wednesday, say around 6.1% or lower, would support the above technical thesis. However, if we see a stronger than expected CPI, say with a reading greater than 7%, it would likely swing the market back towards a more hawkish path for the RBA, and therefore spark a short-covering rally in the AUDUSD which could see it trade back towards 0.6899.

Learn More, Earn More!

Want your portfolio questions answered? Register for next week's Live Market Analysis sessions and attend live! You can ask me about any stock, index, commodity, forex pair, or cryptocurrency you're interested in.

REGISTER:

Live Market Analysis Webinars - Tuesdays & Thursdays 1pm, Friday 12pm AEST

You can catch the replay of the last episode of Live Market Analysis here:

Buy these Tech Giants, but NOT these...Bull market changes gear