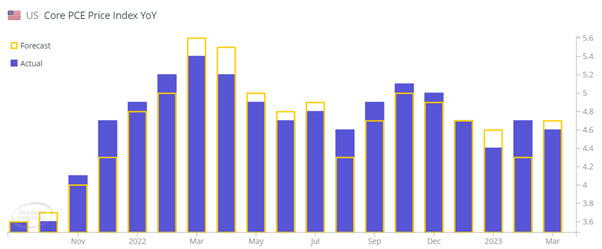

Forex traders will be bracing themselves on Friday, April 28, at 13:30 U.K. time. In the last three months, we saw an annual U.S. Core PCE acceleration, the Fed’s favourite inflation gauge, from 4.4% to 4.7%. The higher-than-expected inflation rate keeps the Fed on track to deliver another rate hike, with the next 25bps rate hike expected on May 3, per the CME Fed Watch tool.

How to trade the Core PCE report

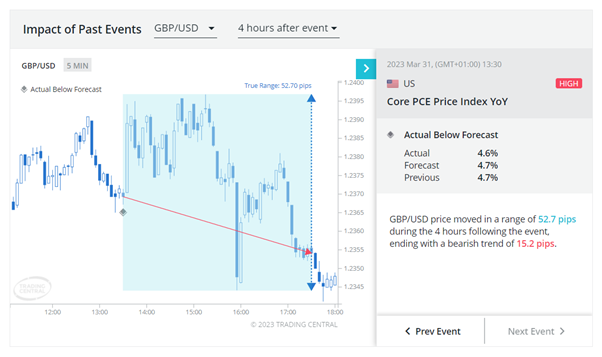

EUR/USD saw volatility of 60.3 pips in the four hours after the 12 past Core PCE data releases, whilst the GBP/USD saw volatility of 81.06 pip in the same period.

In 8 out of the last 12 PCE report releases, the GBP/USD exchange rose four hours after the event, and while the price declined on 4 out of 12 occasions per the

ThinkTrader economic calendar. A price decline was also what we saw last time when Core PCE printed 4.6% vs the 4.7% expected.

The initial reaction was to sell the USD and thereby lift the GBP/USD pair, but after a few hours, the price traded lower, clearly showing how price action and market news does not always make sense. But knowing that the typical range will amount to roughly 80 pips four hours after the news does allow for some structure to the trading.

Big picture outlook

It might be hard to know exactly what will happen with the US Core PCE on Friday. But the technical analysis outlook is more straightforward. As per the chart below, the GBP/USD triggered a double top pattern 22 days ago. This pattern suggests that the price should reach 1.3052. However, 22 days have passed without any material bullish push. The price is trying to trade back into the pattern. If the bears are successful to take out the 1.2340 low, I expect the price to drift to the other side of the range at 1.20.

On the other hand, if the price remains above 1.2340, there is still a chance that the price reaches 1.3050 in the weeks ahead. This Friday’s US Core PCE report could be what seals the fate of the GBP/USD trend.

GBP/USD Daily Chart

This information has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication only. No representation or warranty is given as to the accuracy or completeness of this information.

Investing in derivative products carries significant risks and is not suitable for all investors. Please be aware that you do not own, or have any interest in, the underlying assets. We recommend that you seek independent advice and ensure you fully understand all risks before trading.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre