Gold prices are likely to break below $1300 and Bitcoin could drop below $3000

Gold

Despite a risk averse trade, gold prices are trading lower due to the strength in the dollar index. This suggest that investors are not really hiding, but they are just taking some profit off the table. If this was a full on risk off trade, then we should have seen the evidence of money moving into safe haven- such as gold. Exchange traded funds for gold have reduced their holdings by 245,397 troy ounces of gold. This was the biggest one-day decrease which we have seen since August 2018.

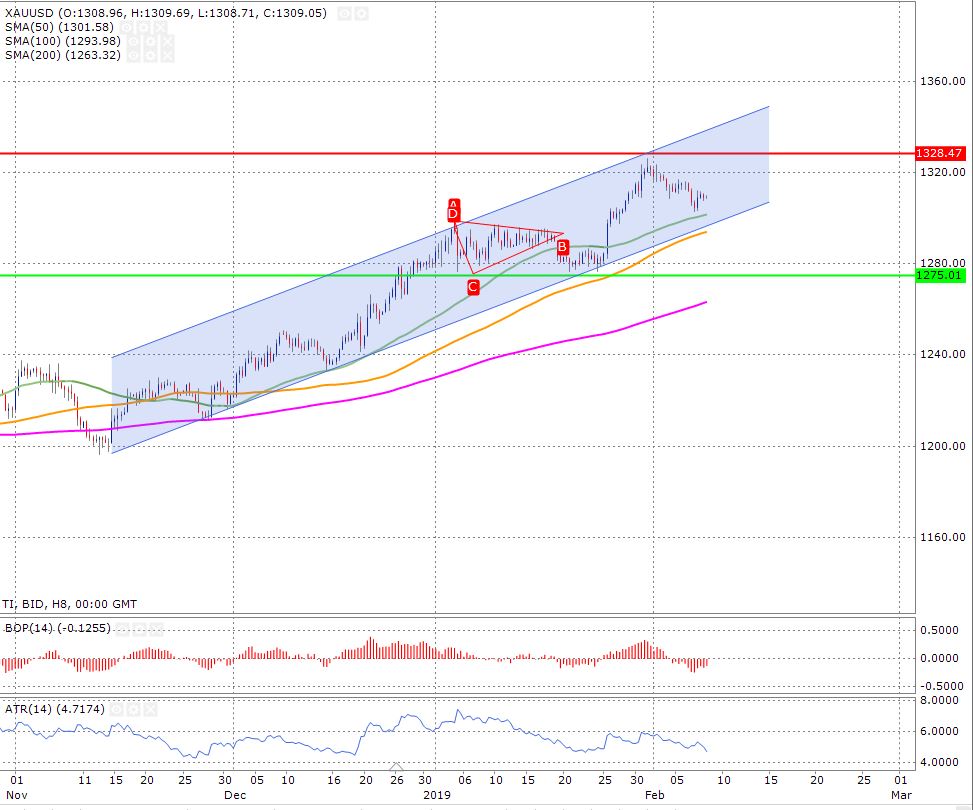

Gold price is heading for a weekly loss and the psychological level of 1,300 remains under a major threat. As we said yesterday, a break below this level is going to attract more pessimism and that would affect the gold price more negatively. The chart below shows the level of resistance and support.

Bitcoin

As for Bitcoin, there is one major theme; consolidation and the volatility cooling off. For the past few weeks, we have not seen any significant movement in the Bitcoin price. We are stuck in a price range of 3183 (17 December low) to 4234 (24

th December high), as long as we are not breaking out of this range, there is nothing new.

However, there are two price levels which majority of the traders are looking at very closely and a break of these levels is likely going to bring excitement. The upper level is 4K mark, if the price breaks this resistance, it assures that the bulls have strong chances of breaking the resistance of 4234, thus stimulating the odds of a bull rally. On the flip side, the support of 3000 is really important for us and no one wants to see the price breaking below this because that will trigger a blood bath on the street. If we break the 3000 mark, the next support is at 2600.

Back

Back