While FX volatility is somewhat still contained but nudging up to multi-month highs, commodity currencies

AUDUSD (-1%) and

NZDUSD (-0.9%)

have naturally felt the full brunt of the sell-off given proximity to China's dire circumstances.

The extension of celebrations and suspension of holiday activities, in an effort to contain the human-to-human transmission of Coronavirus, is also spilling over to tourist-dominated economies, with

USDCNH (+0.8%),

USDKRW (+0.7%) and

USDTWD (+0.4%) seeing outflows in favour of USD safety. In fact,

US safety, targeted in times like this, sees the

US Dollar Index trade marginally below 98.

Equity futures have melted from all-time highs, gapping lower at the week's open.

S&P 500 is

down ~1.5%,

Nasdaq back under 9,000 and

ASX poised to slip 1.1% at the cash start. Contrastingly,

US Treasuries and

Gold are heavily bid as expected.

Implied equity volatility according to

VIX is now at three-month highs of ~17%, though still has some way to go before it reaches what most consider normal volatility conditions of around >20%, but nevertheless, a good sign for vol. traders.

USDJPY and

USDCHF, our go-to

macro recession hedges, indeed reflects investment reversals out of risk assets - but interestingly - haven't been as massively pushed like the equities space. Though, having said that,

USDJPY 1-month implied volatility hasn't been this high since November.

Ultimately, this entire ordeal begs the key question for markets; could this be the spark that volatility was yearning for in 2020? Or will it simply dissipate as quickly as it began? Only time will tell. It's inherently very difficult to pick apart unknown risks like the Coronavirus, which evidently, has failed to make it to the top 1,000 risks of any Tom, Dick and Harry in 2020 - myself included. People simply don't conceive that tail-risk events like the Coronavirus will happen.

But since we're in this predicament, portfolio flows are likely to continue to taking advantage of cheap risk-off hedges in short

USDJPY and taking a portion of profits off the table in equities space. However, one thing to note is that we're in the thick of US earnings season, a potential stabiliser to what has transpired early this week.

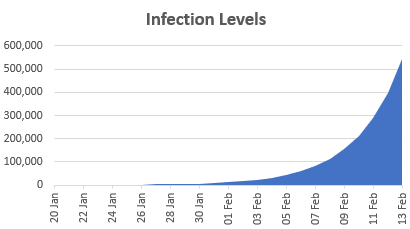

Extrapolation of daily growth rate (~37%) of infection levels.

Source: ThinkMarkets, confirmed cases, estimates only