Although things quietened down in the second half of this week due to Thanksgiving in the US, this has been yet another “risk-on” week for the financial markets. The major global stock indices edged further higher, hitting or nearing new record highs, as ongoing central bank and government support combined with news of vaccines provided the perfect mix for bullish speculators to buy or hold onto their stocks. As a result, the Dow surpassed 30,000 for the first time, while the small-cap Russell 2000 index also hit a record high, before pulling back slightly. Japan’s Nikkei rose to new highs, while Chinese and Australian stocks drifted further higher. In Europe, the DAX consolidated its recent gains near its all-time high, while the region’s other indices all eked out gains – except the FTSE which was flat on the week at the time of writing. Hopes that travel would resume next year, and the OPEC will delay hiking output caused oil prices to break out, with Brent reaching $49 and WTI $46, before both contracts pulled back slightly. As stocks and crude oil rallied, haven gold fell sharply before trying to break key support around $1800 on Friday. Bitcoin, which some consider to be a better store of value than gold, initially extended its recent rally and almost reached its 2017 record high of just under $20K, before profit-taking caused prices to slump. The “digital gold” was on course to post its first weekly loss in eight weeks. In FX, the Dollar Index fell as it threatened a long-term uptrend around the 92 handle. Among the majors, the New Zealand dollar extended gains for the fourth week, while other commodity dollars also rose, as too did the euro.

Looking Ahead

Heading into the week ahead, I am expecting a continuation of the ongoing “risk-on” trade given the strong bullish momentum – that is, unless something changes fundamentally. We have heard of positive vaccine news in every Monday of the past three weeks. Will this trend continue again? If so, expect another burst of buying momentum. Meanwhile, the latest face-to-face Brexit talks will resume and the OPEC meeting is on Monday, which should provide plenty of fireworks for the pound and crude oil, respectively. In the slightly longer-term outlook, though, there are good reasons to be cautious – see, for example, the paragraph I have written on central banks in 2021, below.

Brexit talks resume

On Friday, the pound eased of its recent highs as Brexit talks entered the final stretch. EU's Chief Brexit negotiator, Michel Barnier, is out of self-isolation and was traveling to London for talks to take place over the weekend ahead of UK’s exit from the single market at the end of the year.

Contrary to the recent optimism, Barnier provided a more downbeat assessment of the current state of talks as he warned that big disagreements between both sides still exists. This is something which Boris Johnson also echoed, with the UK Prime Minister adding that the ball was in EU’s court. UK’s Brexit negotiator, David Forst, said any deal would have to "fully respect UK sovereignty," including over fishing waters and a regime for subsidising businesses, as “agreement on any other basis is not possible."

If a trade deal is not agreed by the end of the year, trading between the two will default to World Trade Organization rules which means tariffs will be introduced, raising costs on products and potentially causing a severe economic shock.

As a potential deal is being priced in, this means the upside for the pound could be less than compared to the potential downside risks from here. A deal could lift the cable to $1.40, while a no-deal exit could see the pound plunge below $1.20. So, the stakes are high – trade the pound with extra caution as we approach year-end.

OPEC agreement to extend supply curbs could send oil to $50+

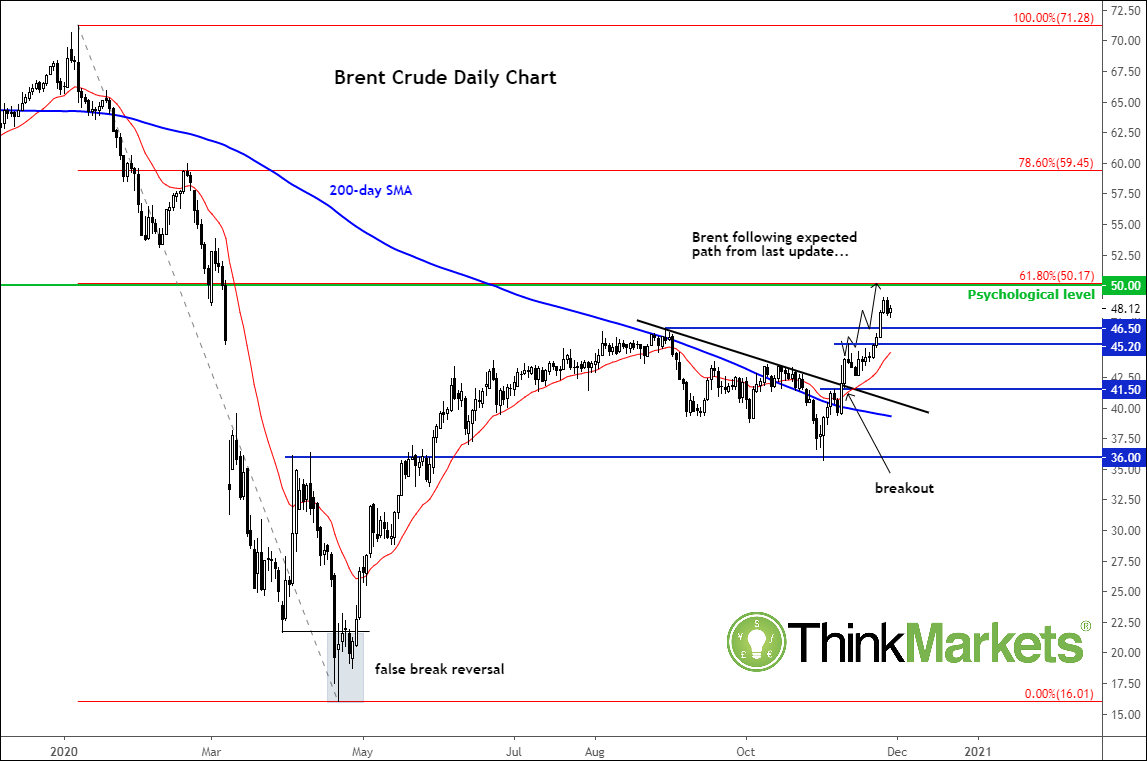

Crude oil prices have surged higher this month on the back of hopes over a strong recovery in demand in 2021, when travel is expected to resume thanks to the recent developments of the vaccine for coronavirus. In the short-term, concerns remain that the latest lockdowns are hurting demand, which is something the OPEC must address when deciding on supply curbs on Monday. There are some fears that that the proposal to extend the current supply cuts has not gone down too well with some members of the OPEC, including Iraq, the United Arab Emirates and Nigeria. But to achieve a deal, and to prevent a fresh free-fall in oil prices from their current levels, we may see OPEC’s de facto leader, Saudi Arabia, agree to a larger output cut to offset any potential supply increases from struggling members. The stakes are high, and the OPEC knows full well the dangers of releasing too much oil back into the market too quickly. So, a deal to extend the current curbs looks the more likely outcome to me, which, if seen, could pave the way for Brent oil to reach and possibly breach the $50 a barrel mark next week.

What will central banks do in 2021?

Amid all the optimism about more normal times ahead, could we see the return of taper tantrum in the second half of 2021 as central banks start to normalise their balance sheets? That’s certainly a worry for another day, perhaps sooner than some expect, as right now investors are still cheering news of successful vaccine candidates for coronavirus. Still, with the markets having been in a general uptrend since March, there is always the danger for a pull back as the positively gets priced in and investors look further out, and one key concern that may arise in the coming weeks and months could be about the future of monetary policy in 2021. With things hopefully going back to normal, would will this mean the end of an era for extraordinary loose monetary policy? If central banks start to shrink their huge balance sheets in 2021, so the prices of extremely overvalued stocks might fall, especially those on Wall Street. Currently, this is the last thing people are thinking about and there are no signs that it will happen any time soon. Indeed, the ECB is about to expand its balance sheet further in December. But if the vaccines trigger a sharp recovery for the world economy, and inflation is overcooked, then this could lead to tightening of monetary policy by major central banks in the second half of 2021. And with it, the markets might actually fall back.

Immediate concerns: impact of latest lockdowns and stimulus uncertainty

But as I mentioned, the above might be a longer-term worry for investors. The immediate concern is if vaccines are not distributed fast enough or the US and EU fail to release fresh stimulus funds soon, because the impact of the latest lockdowns are slowly beginning to show in hard data again. If next week’s upcoming data releases paint a very bleak economic outlook, then demand concerns could come back to haunt investors, leading to a short-term pullback for risk assets. Still, optimism over vaccines should mean the downside will be limited. So, I would continue looking to fade the short-term dips near support rather than fade rallies into resistance, until the charts tell us otherwise.

Data highlights

As mentioned, investor focus will slowly turn back to data, after vaccine developments raised hopes for a more normal 2021 and the end of lockdowns, which in turn means the end of government support and the potential for tax rises. Central banks will keep the taps open initially, but if data starts to improve rapidly then policy tightening could be a possibility later in 2021. So, it is worth watching which countries will be able to outperform and which ones will lag behind. Data from now on should start to impact expectations over policy changes. Luckily the economic calendar for the week ahead if full of potentially market-moving events. Among them, these are the most important in my view:

- Monday: China manufacturing PMI and OPEC meeting

- Tuesday: RBA rate decision and ISM manufacturing PMI

- Wednesday: Aussie GDP and Fed Chair Powell testimony

- Thursday: US jobless claims and ISM services PMI

- Friday: Monthly employment reports from both US and Canada

Chart to watch: Crude Oil

Source: ThinkMarkets and TradingView.com

With the OPEC set to decide whether to extend or relax the current supply curbs on Monday, crude prices could move sharply. The trend is currently bullish for Brent oil, which looks set to climb to $50. Key supports include $46.50, $45.20 and then there is nothing significant until $41.50. The ideal scenario for bulls would be a pullback to the $46.50 and a nice bounce there.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.