In Monday’s trading session in the local markets, the Top 40 closed the day up by 1.4%. The Resources 10 sector went up by 2.81%, the Financial 15 went up by 0.25%, the Industrial 25 went up by 0.69% and lastly the South African Listed Property index up by 0.32%. The Rand traded at R15.04 against the United States Dollar, R20.46 against the Great British pound, and R17.38 against the Euro. The local markets had a positive day mainly thanks to the Resources sector climbing by 2.81%. The Iron Ore spot price climbed after a 49% first-quarter drop. According to reports, more than 80% of China’s domestic steel mills have suspended operations for maintenance in September.

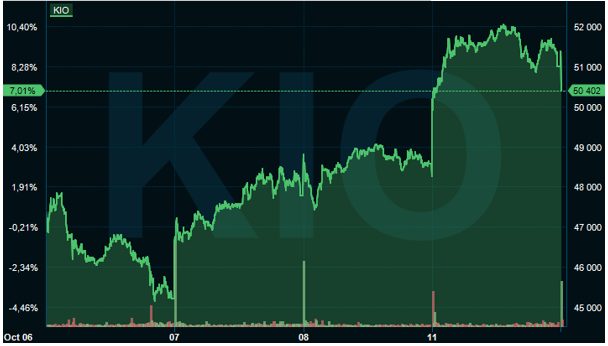

Figure 1: Kumba Iron Ore one week chart

On the commodities front, the Brent Crude oil is trading at $83.54 a barrel and WTI Crude oil is traded at $80.28 a barrel. Gold Spot price is currently trading at $1761.23; Platinum Spot is now trading at $1014.46 and lastly, Palladium Spot price is at $2108.48. Brent crude oil climbing to more than $84.0 a barrel on Monday, the highest since October 2018 and following five weeks of gains, with expectations of a near-term uptrend remain intact. And WTI crude traded above $80 a barrel on Tuesday after hitting above $81 a barrel for the first time since October 2014.

Across the globe, the S&P 500 closed the day down 0.29%, Dow Jones closed down 0.34% and the Nasdaq had a 0.13% dip. The FTSE 100 closed up 0.72% and the DAX was down 0.05% and CAC40 was up 0.16%. In the Asian markets, the Nikkei 225 is down 0.94% and the Hang Seng is currently down 1.79%. Elsewhere, Bitcoin is shy of $60’000 following a strong rally

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre