In Tuesday’s trading session in the local markets, the Top 40 closed the day down by 0.05%. The Resources 10 sector went down by 0.53%, the Financial 15 went down by 0.36%, the Industrial 25 went up by 0.57% and lastly the South African Listed Property index up by 0.74%. The Rand traded at R14.66 against the United States Dollar, R20.14 against the Great British pound, and R17.03 against the Euro. In the morning, Pick n Pay reported the company's interim results which ended on the 29

th of August 2021. The company reported that for the first half of their financial year, they had an 87% increase in profits after tax compared to the same period last year and a 90.9% increase in the comparable headline earnings per share. Lastly, they declared an interim dividend of 35.80 cents per share.

On the commodities front, the Brent Crude oil is trading at $83.68 a barrel and WTI Crude oil is traded at $81.79 a barrel. Gold Spot price is currently trading at $1775.74; Platinum Spot is now trading at $1047 and lastly, Palladium Spot price is at $2104.40. Oil prices remain high due to supply-demand imbalances in the energy markets amid high coal and natural gas prices combined with falling temperatures as Northern Hemisphere winter approaches.

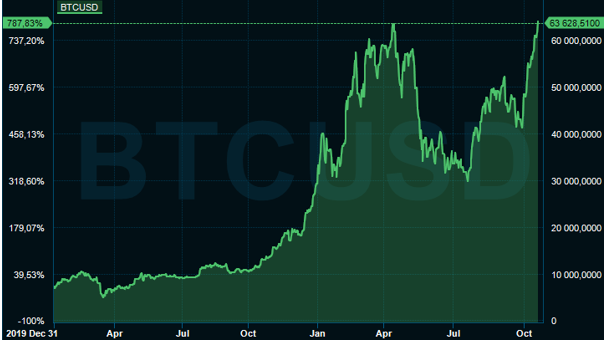

Across the globe, the S&P 500 closed the day up 0.7%, Dow Jones closed up 0.51% and the Nasdaq had a 0.75% climb. The FTSE 100 closed up 0.19% and the DAX was up 0.27% and CAC40 was down 0.05%. In the Asian markets, the Nikkei 225 is up 0.14% and the Hang Seng is also currently up 1.24%. The S&P 500 was close to all-time highs after yesterday’s trading session as a few companies released Q3 results. Johnson & Johnson rallied 2.34% on earnings beating expectations, while Procter & Gamble dropped 1.81% after announcing it will raise prices due to supply chain issues. Netflix reported earnings and subscriber growth, while United Airlines gained 2% in after-hours on travel rebound. There are several companies are looking to report results before and after the trading session in the United States such as Verizon, Biogen, Tesla, IBM and Discover. Elsewhere, the second-highest traded fund ever was the Bitcoin Futures ETF, with a turnover of almost $1 billion, on its first day of trading. Meanwhile, Bitcoin made a run at its record high of just under $65,000.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre