In Thursday’s trading session in the local markets, the Top 40 closed the day down by 2.29%. The Resources 10 sector went down by 1.90%, the Financial 15 went down by 1.18%, the Industrial 25 went down by 2.79% and lastly the South African Listed Property index down by 0.20%. The Rand traded at R14.19 against the United State Dollar, R19.65 against the Great British pound, and R16.79 against the Euro. JSE was hammered because the heavy weights, Naspers and Prosus tanked 7.82% and 6.3%, respectively, due Chinese regulations on tech firms. Rand strengthened on Thursday due as they were a large surplus of current account recorded in the second quarter (342.8B vs 305.1B forecast). In the latest news, Aspen jumped 7% after bids. Sanlam has set a 50 million customer base growth by 2025. Sanlam is planning to exit several of its UK-based operations. South Africa manufacturing production (MoM) (Jul) declined 4.1% on a year-on-year basis vs 3.6 forecast.

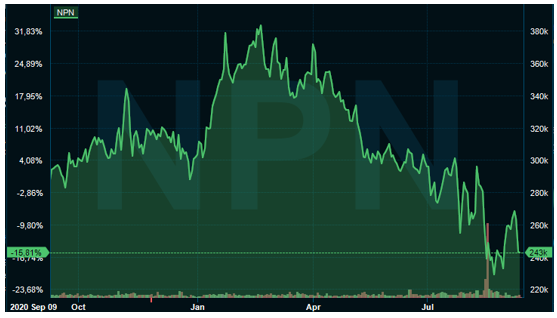

Figure 1: Naspers 1 year share price graph

Figure 1: Naspers 1 year share price graph

On the commodities front, the Brent Crude oil is trading at $72.05 a barrel and WTI Crude oil traded at $68.67 a barrel. Gold Spot price is currently trading at $1801.42, Platinum Spot is now trading at $982.50 and lastly, Palladium Spot price is at $2219.31. Oil prices rose on Friday on growing signs of tightness in U.S. markets after Hurricane Ida hit offshore output. Gold was down on Friday as the dollar strengthened and uncertainty over tapering grows.

Across the globe, the S&P 500 closed the day down 0.46%, Dow Jones closed down 0.43% and the Nasdaq had a 0.38% down. The FTSE 100 closed down 1.01% and the DAX was up 0.08% and CAC40 was up 0.24%. In the Asian markets, the Nikkei 225 is up 1.25% and the Hang Seng is currently up 1.37%. US weekly jobless claims at nearly 18-month lows soothed fears of a slowing global growth affecting the indices. The Nikkei 225 was up due to the hopes of a domestic economic rebound following Prime Suga’s resignation last week. In terms of global latest news, UK Industrial Production (MoM) (Jul) increased to 1.2 % vs 0.4% forecast, German CPI (YoY) (Aug) increased to 3.9% vs 3.9% forecast.

Things to look out for today in the trading day, US Core PPI (MoM) (Aug) at 14.30 pm, NIESR Monthly GDP Tracker at 15.00 pm and US Wholesale Inventories (MoM) at 16.00 pm.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre