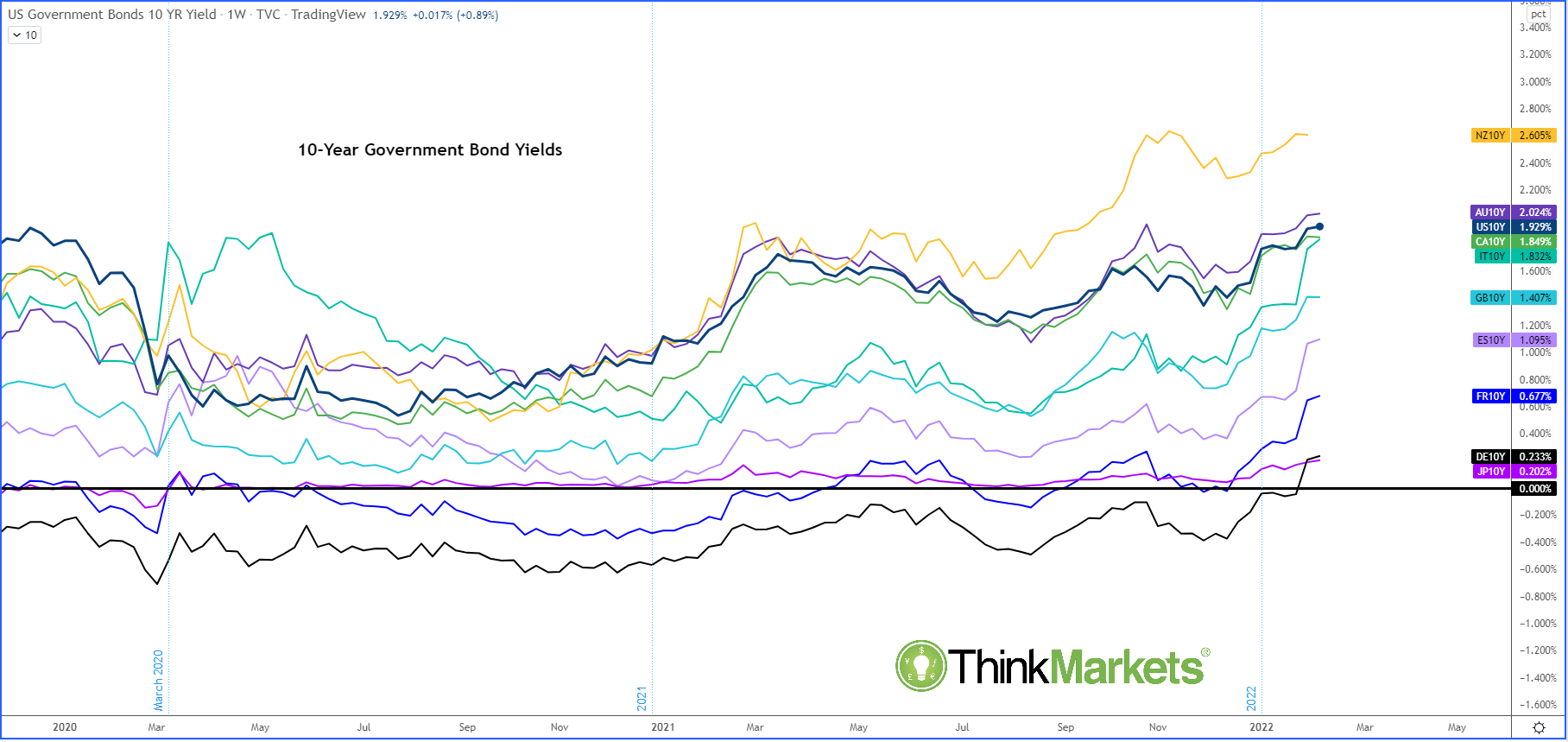

The key takeaway point from a rather busy last week was this: interest rates are going to rise quicker than previously thought. At the start of this week, investors have continued to offload government bonds, sending their yields higher:

The BoE and ECB were more hawkish than expected, with a bigger split in the former in deciding how much to raise rates by. In the US, the much stronger non-farm payrolls report, plus more signs of rising inflationary pressures, cemented expectations of a faster rate hiking cycle over there. While yields have extended their gains, the equity markets have started the new week on a stronger footing – except in some peripheral European countries.

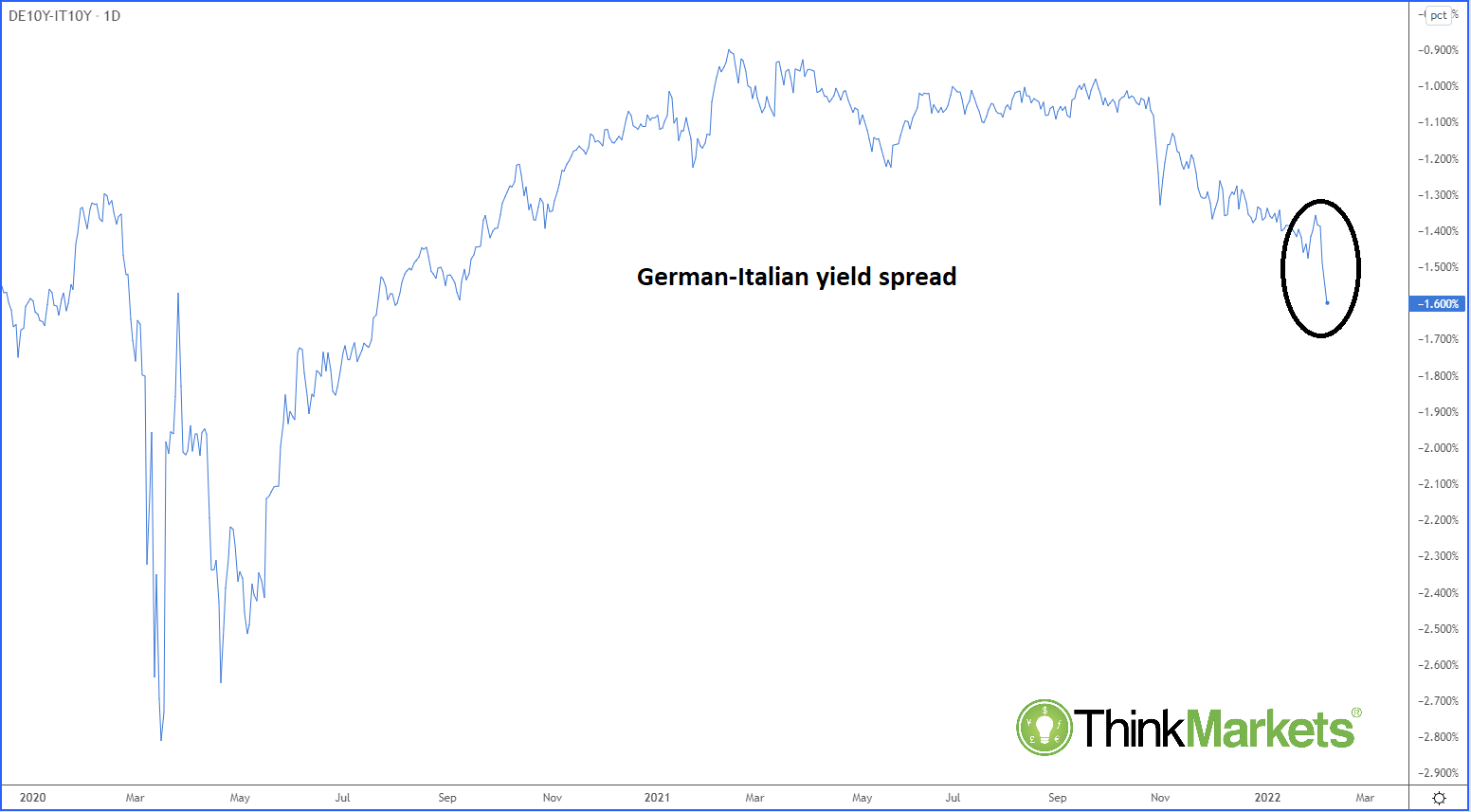

The bond selling has been more profound for

European peripheries, with Greek and Italian yields sharply widening their gaps against German bunds.

This is because peripheral Europe has been the major beneficiary from ECB’s emergency stimulus measures. With investors now pricing in a faster removal of QE by the ECB, they are taking no chances. The Italian benchmark stock index was down around 1.5% today, sharply under-performing the likes of the UK’s FTSE and the German DAX indices.

Still, the wider European equity markets are holding their own well and for those that have fallen the losses have been very mild relative to how much they have gained. It remains to be seen whether stock investors will panic more if yields rise further, and yield spreads widen even more.

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre