The key question investors would be asking themselves is whether Thursday’s sharp recovery off the lows for global indices marked a turning point. So far, we haven’t seen much bullish follow-through in US index futures to suggest that is the case, and you can understand why with everything happening on the ground in Ukraine. What’s more, the existing macro concerns – soaring inflation and the upcoming interest rate hikes – are further discouraging stock market investors. Today’s Core PCE Price Index, the Fed’s favourite inflation gauge, could revive those worries with a print well north of the 5.1% y/y expected.

Meanwhile safe-haven

gold is currently flat on the session, after a remarkable session on Thursday when at one point it looked like it was heading to $2000, only for the sellers to step in aggressively as the US dollar rebounded sharply. But the metal is going to react more to the risk-on/risk-off trade, which means gold investors will be watching the stock markets closely today, and news from Russia and the West as they engage in a bit of tit for tat in terms of sanctions after Moscow’s invasion of Ukraine.

Given the potential for inflation to accelerate further with crude oil and gas prices finding renewed support from the Russian invasion,

risk seeking might remain out of favour. There is the additional factor of the

weekend risk to take into account. You wouldn’t want to go into the weekend knowing there is a good chance the market could gap against you at the next week’s open, as the situation in Ukraine could deteriorate and

tensions between Russia and the West could boil over.

Against this backdrop, I wouldn’t be surprised if the markets come under renewed pressure heading into the close today.

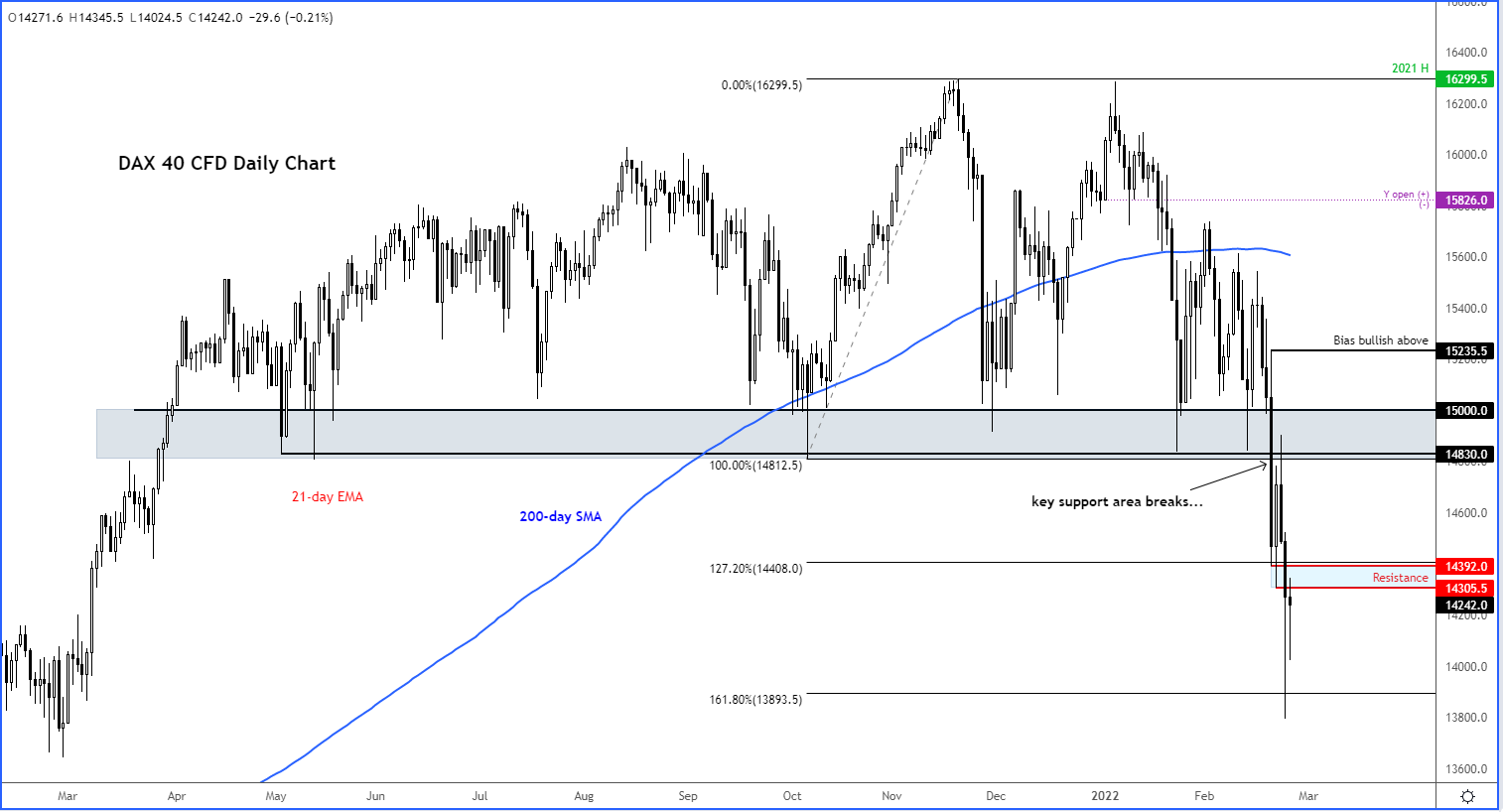

Source: ThinkMarkets and TradingView.com

Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Learn and earn more today.

Visit our Education Centre