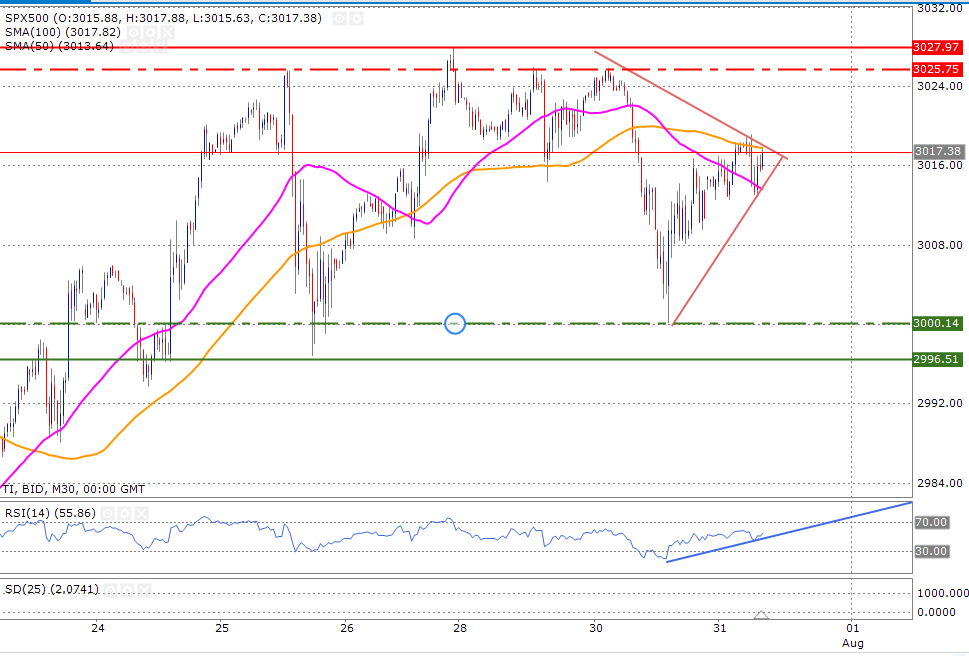

*Bearish crossover has pushed the price lower *If bulls want to take the control back, the price needs to break above the 100-day moving average

The S&P500 index is in a strong uptrend on a daily time frame and this means that as an intra-day trader, any bets should be in line with the bigger time frame’s trend.

Looking at the 30-minute time frame, the price has formed a symmetrical triangle pattern and they usually break in the direction of the current trend. However, there is no clear trend on this intra-day time frame as the price is mostly consolidating. This is where the moving averages can provide some clues.

The reason that the bulls are in control of the price is because the price is trading above the 50-day moving averages (shown in pink). However, bulls do need more help otherwise the current upward move may fail. This can occur if the price fails to break above the 100-day moving average (shown in orange).

Thus, it becomes clear that if the price fails to remain above the two important moving averages then the symmetrical triangle pattern would push the price to the downside. It is also likely that the price may actually fall well below the major support zone mentioned below.

As for the RSI, it is trading in an uptrend, however if it breaks below the upward trend line, this could be the first confirmation that the bears are about to start their party-meaning more weakness ahead.

Major support 2,996

Minor support 3,000

Major resistance 3,027

Minor resistance 3,025

Back